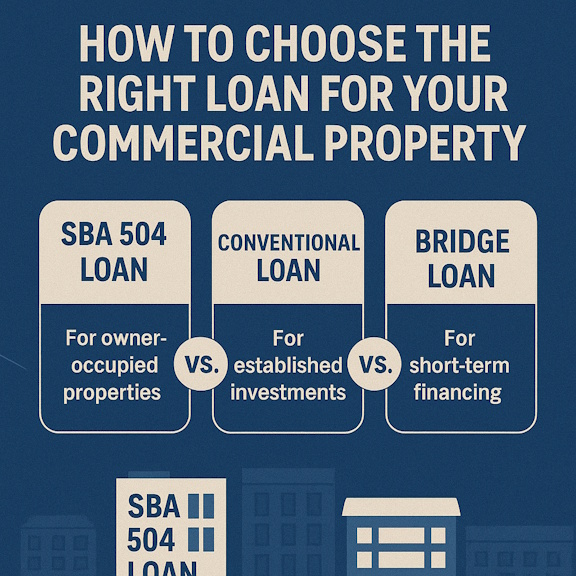

You’ve found the perfect commercial property—but now comes the real question: How do you finance it? Whether you’re launching a small business, expanding a local operation, or investing in new construction in Athens, Alabama, choosing the right commercial loan could mean the difference between a deal that thrives—and one that drains you. From SBA to […]

Recent Comments