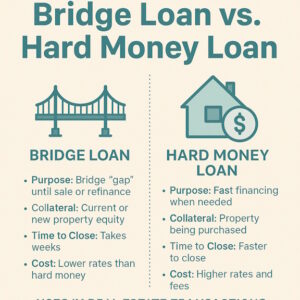

No tax returns? No problem. Here’s how to qualify based on the deal—not your credit score. A bridge loan can be a true game-changer in Decatur’s fast-moving real estate market—especially when you’re racing against time to close on a new home, lock in a flip, or move on an investment before someone else beats you […]

Recent Comments