Embarking on a commercial real estate investment journey in North Alabama? Understanding the financing landscape is crucial. Let’s delve into the essentials of securing a commercial real estate loan in this thriving region.

Navigating the Commercial Loan Landscape

Think of commercial real estate financing as a roadmap. Each route—be it a conventional loan, SBA 504, or bridge loan—offers different paths to your investment destination.

Key Loan Types:

- Conventional Loans: Offered by banks and credit unions, these loans typically require a 20-30% down payment and are suitable for stabilized properties.

- SBA 504 Loans: Ideal for small businesses, these loans offer up to 90% financing for owner-occupied properties, with fixed interest rates and long terms .

- Bridge Loans: Short-term loans that provide quick capital, often used for property renovations or to bridge the gap until permanent financing is secured.

Tip: Assess your investment goals and property type to determine the most suitable loan option.

Understanding Lender Expectations: What It Really Takes to Get a ‘Yes’

Securing a commercial real estate loan isn’t just about having a dream project—it’s about proving to the

lender that your deal makes financial sense. Think of the lender as your business partner. Before they write a check, they want to know your project is low-risk and high-reward.

Let’s break down what lenders are actually looking for when reviewing your loan application:

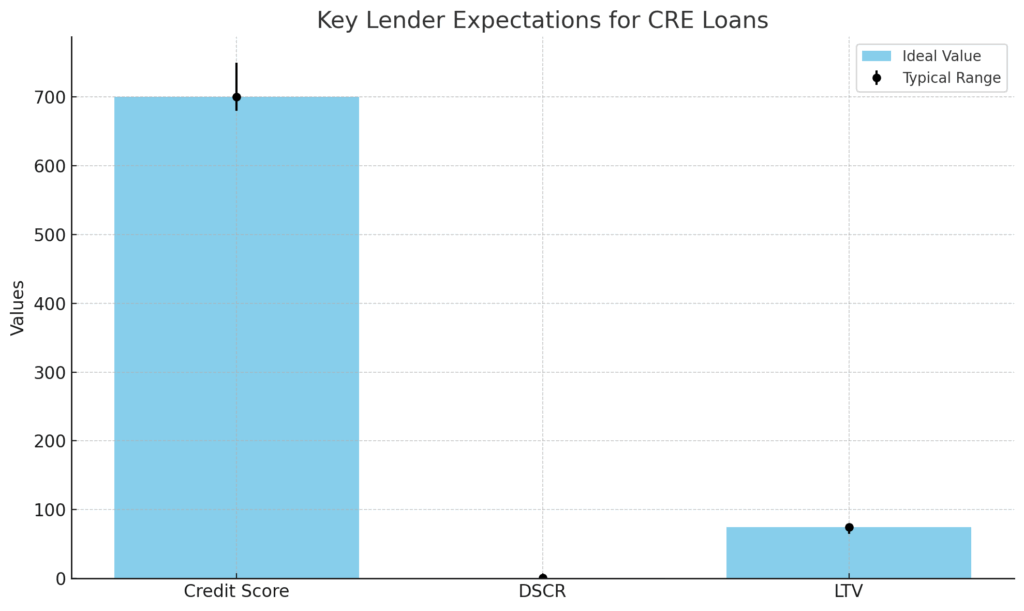

🧾 Creditworthiness: Your Financial Reputation on the Line

Your credit score is the first thing under the microscope. Most commercial lenders look for a score of 680 or higher. But they don’t stop there—they’ll review your personal and business credit reports for red flags like late payments, bankruptcies, or too much outstanding debt.

“Trust is built on a track record. A strong credit history shows that you honor your commitments,” says Kevin Donovan, a senior CRE loan underwriter.

Tip: Check your credit reports in advance and dispute any errors. Lenders love transparency, so being upfront goes a long way.

💰 Debt Service Coverage Ratio (DSCR): Can Your Property Pay for Itself?

The DSCR compares a property’s net operating income (NOI) to its annual debt payments. A ratio of 1.25 means you earn 25% more than your debt obligation—enough cushion for lenders to feel comfortable.

- A DSCR under 1.0? That’s a red flag.

- Above 1.5? Now you’re talking investor-grade.

Tip: Boost your NOI by cutting unnecessary expenses or increasing rental income before applying.

📊 Loan-to-Value Ratio (LTV): The Equity Test

This ratio shows how much of the property’s value the lender is willing to finance. A lower LTV means you’re putting in more equity, which reduces the lender’s risk.

- Common LTVs for CRE loans: 65–80%

- That means you’ll need 20–35% skin in the game.

“Lenders want to see that you have a personal stake in the deal. The more you invest, the more confident they feel,” notes CRE advisor Melissa Chan.

Tip: Be prepared to show proof of funds for your down payment and any closing costs upfront.

Bonus Tip: Always come armed with a well-prepared business plan. This should include financial projections, market analysis, property management strategy, and exit plans. It’s your pitch deck—make it count.

According to a 2023 report by the Mortgage Bankers Association, applicants with organized documentation and detailed plans were 37% more likely to secure loan approval.

The Loan Application Process

Securing a commercial real estate loan involves several steps:

- Pre-qualification: Assess your financial readiness and loan options.

- Application Submission: Provide detailed financial documents, property information, and business plans.

- Underwriting: The lender evaluates your application, conducts appraisals, and assesses risk.

- Approval and Closing: Upon approval, legal documents are signed, and funds are disbursed.

Tip: Engage with a knowledgeable commercial loan broker to navigate the process efficiently.

Local Market Insights: North Alabama

North Alabama’s commercial real estate market is diverse and growing:

- Huntsville: A hub for technology and defense industries, offering opportunities in office and industrial spaces.

- Birmingham: Known for its healthcare and finance sectors, with a strong demand for multifamily and retail properties.

- Athens and Decatur: Emerging markets with potential in logistics and manufacturing facilities.

Tip: Stay informed about regional economic trends to identify lucrative investment opportunities.

Conclusion

Securing a commercial real estate loan in North Alabama requires a clear understanding of financing options, lender expectations, and the local market. By preparing thoroughly and seeking expert guidance, you can navigate the process confidently and make informed investment decisions.

Ready to explore your commercial real estate financing options in North Alabama? Email me at: jdawson@alacapital.com or visit our Contact Us page.

Recent Comments